In Australia, the Australian Taxation Business office (ATO) plays a vital position in making sure that tax polices are honored by enterprises and folk. When it comes to contingent workers, such as freelancers, contractors, and short term personnel, the two employers and workers have to navigate ATO compliance to prevent penalties and legal difficulties. In this post, we are going to check out the real secret areas of ATO compliance for contingent personnel in Australia.

1. Worker or Contractor? The Classification Obstacle:

The Firstly ATO compliance worry is effectively classifying personnel. The ATO has clear suggestions regarding the difference involving workforce and contractors. Misclassification can result in legal and monetary effects. Comprehension the discrepancies is important to confirm who's accountable for tax obligations.

2. ABN and TFN: The Essential Quantities:

For ATO compliance, all contingent employees must have an Australian Enterprise Number (ABN) plus a Tax File Quantity (TFN). Businesses ought to ask for and verify these figures from their contingent staff. Contingent workers should present their ABN on invoices along with their TFN when questioned.

three. The Spend While you Go (PAYG) Process:

Contingent workers usually run beneath the PAYG withholding method. In This technique, companies withhold a portion Together with the payment as tax, making sure the ATO gets its share. It is the accountability of companies to withhold the right amount, based around the employee's TFN declaration or withholding declaration.

four. Superannuation Contributions:

Superannuation contributions undoubtedly are a crucial component of ATO compliance for contingent staff. Normally, employers typically aren't forced to deliver about a contractor's superannuation fund. Having said that, the particular scenario could improve based over the contractor's classification or perhaps the precise terms while in the deal.

five. Compliance with Fair Perform Legislation:

ATO compliance should really align with Honest Operate Act necessities. Businesses must make sure that their contingent personnel have the minimum amount wages and entitlements prescribed with the Good Do the job Act, despite their classification as contractors.

six. Report-Trying to keep for ATO Compliance:

Preserving accurate documents is very important for ATO compliance. Companies should keep detailed data of payments, ABNs, TFNs, and tax withheld. Contingent workers also must keep records of revenue, charges, and tax obligations.

7. Reporting on the ATO:

Employers are necessary to report contractor payments for that ATO in the Taxable Payments Once-a-year Report (TPAR). This report details payments to more info contractors and subcontractors, which includes their ABNs. It truly is submitted on a yearly basis.

eight. Implications of Non-Compliance:

Non-compliance with ATO regulations can convey about penalties, fines, and lawful consequences for each employers and contingent workers. Right classification, accurate record-maintaining, and timely reporting are essential to prevent these types of difficulties.

In conclusion, ATO compliance for contingent workers in Australia is mostly a complex but vital facet of contingent workforce management. Companies and workers must be effectively-educated with reference into the restrictions surrounding personnel classification, tax obligations, superannuation, and good operate laws. By keeping with ATO guidelines, firms can make sure that their contingent workforce operates inside of bounds with the legislation, averting costly penalties and legal complications. To make certain compliance, it's been extremely theraputic for organizations to consult with with lawful and tax industry experts or use payroll products and services proficient in contingent employee management.

Jennifer Grey Then & Now!

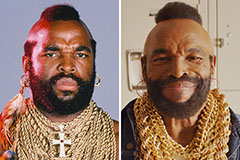

Jennifer Grey Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!